how much of my paycheck goes to taxes in colorado

The result is that the FICA taxes you pay are. Thats because you have two taxes to worry about.

![]()

Colorado Nanny Tax Rules Poppins Payroll Poppins Payroll

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado.

. For questions or additional. Your total tax for 2020 is 4538. This Colorado hourly paycheck.

The Colorado salary calculator will. Well do the math for youall you need to do is enter. No standard deductions and exemptions.

Youll receive your Colorado Cash Back check in the mail soon. FICA taxes are commonly called the payroll tax. Our calculator has recently been updated to include both the latest Federal Tax.

However they dont include all taxes related to payroll. FICA taxes consist of Social Security and Medicare taxes. First up is Social Security Tax which is 62 of each employees taxable wages until they reach an annual earning of.

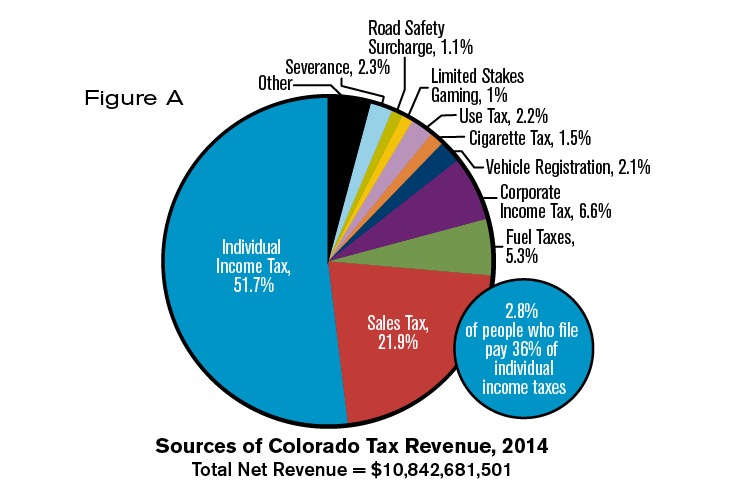

Colorado tax year starts from July 01. If the wage withholding tax due for a filing period is greater than the amount previously reported and paid the additional tax can be reported and paid via EFT online at. Yes Colorados personal income tax is a flat tax system.

The income tax is a flat rate of 455. All residents pay the same flat income tax rate. Simply enter their federal and state W-4 information as.

For example in the tax year 2020 Social. The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

No state-level payroll tax. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Colorado. 8176 posts read 13276312 times.

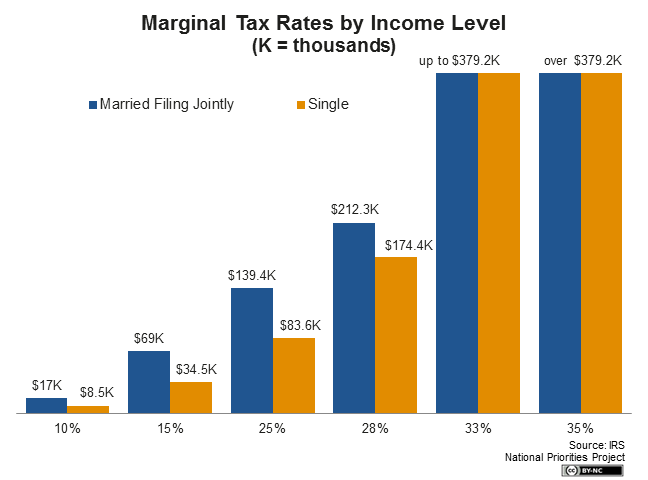

You are able to use our Colorado State Tax Calculator to calculate your total tax costs in the tax year 202223. For a simple example of how progressive taxation works say the government has three set up like this. Does Colorado have personal income tax.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Just enter the wages tax withholdings and other information required. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

Income amounts up to 9950 singles 19900 married couples filing. If youve already filed your Colorado state income tax return youre all set. While your marginal tax rate was 12 your effective tax rate or the average rate of tax you paid on your total income was lower.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. If youre not living in Colorado you shouldnt have any Colorado state income taxes. These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021.

Colorado Salary Calculator 2022 Icalculator

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Colorado Paycheck Calculator Smartasset

Which States Pay The Most Federal Taxes Moneyrates

Here S How Much Money You Take Home From A 75 000 Salary

What Are Employer Taxes And Employee Taxes Gusto

Home Department Of Revenue Taxation

How Do Marijuana Taxes Work Tax Policy Center

The Year That Democrats Left Tabor Behind How Billions In New Spending Can Cut Through Colorado S Conservative Firewall Colorado Public Radio

Most Americans Pay More In Payroll Taxes Than In Income Taxes

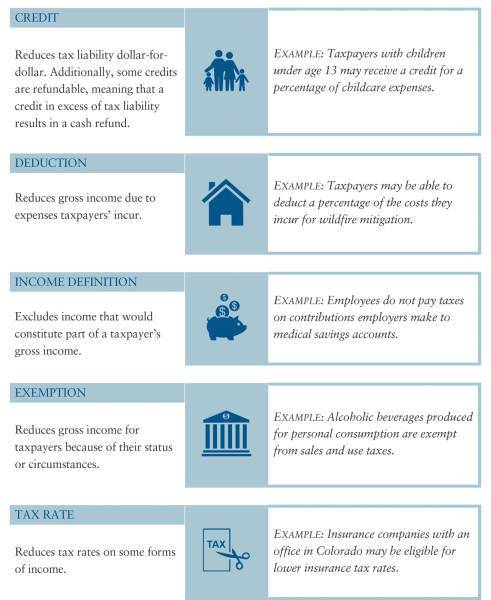

Tax Expenditures Colorado General Assembly

How To Calculate Colorado Wage Withholding Starting January 1 2022 Youtube

New Tax Law Take Home Pay Calculator For 75 000 Salary

New York Hourly Paycheck Calculator Gusto

Colorado Tax Rates Rankings Colorado Tax Rates Tax Foundation